Selection of Discount Rates

Selection of an appropriate discount rate is important, particularly for longer projects. An organisation using inappropriately high discount rates risks rejecting viable projects and favouring short term projects over superior longer term projects.

When organisations decide whether or not to fund a project, the make a choice between that project and other opportunities. Such opportunities may include other projects, investments or returning cash to the organisation's owners. A project's discount rate should reflect the cost of turning down opportunities of equivalent risk.

Company Discount Rates

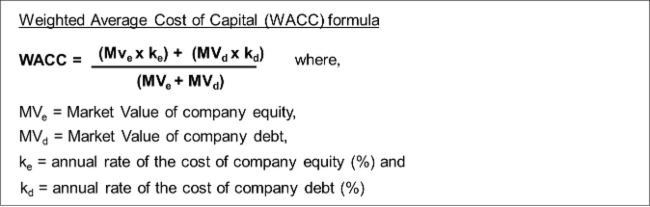

Companies fund projects with capital that could otherwise be returned to their owners. In general, the opportunity cost of funding projects is thus equal to the cost of capital. The most common approach used by companies as a starting basis for setting discount rates is thus to calculate the weighted average cost of capital (WACC). WACC is calculated after tax and sets a discount rate at nominal rates i.e. including the effects of inflation. The formula for its calculation is shown in the box below.

The WACC reflects the company's exposure to market risk (often called systematic risk). For example, a utilities company might be able to raise capital at lower rates than an IT company because the relevant markets for shares (equities) or debt perceive it to expose them to a lower level of risk.

Although a company's WACC might represent a suitable discount rate for many of its projects, there may be exceptions in which adjustments are appropriate. They arise from either variance between the market risk inherent to different types of project or circumstances that break with assumptions used to calculate the WACC. The following are examples:

- The market risk associated with a type of project is not representative of the market risk across the organisation's activities.

- The project is tied contractually to a specific source of funding.

- The project cash flows will be realised in a different currency to that used for the WACC calculation.

- The project lifecycle duration varies significantly from the debt maturity period implied by the cost of debt used to calculate the WACC.

Blanket Adjustments to discount rates - a practice to be avoided

Many organisations add a standard premium to the WACC when deriving their discount factor for projects, often to account for risk. This form of blanket adjustment is not recommended because:

- A blanket discount rate adjustment fails to differentiate between projects that may have significantly different levels of risk. The better approach is to include the implications of project-specific risk directly in NPV models.

- The use of a blanket adjustment is lazy way of accounting for risk in that it provides no insight into how the design of projects can be made more risk-robust. In contrast, the inclusion of project-specific risk in models helps to identify ways of managing the risks involved.

- Unjustifiable increases in discount rates result in an irrational discrimination against projects with longer lifecycles. They may also foster a culture of using unrealistically optimistic estimates to get projects approved.

Government discount rates

In the case of government organisations, projects are, in effect, funded by national debt, the interest on which is paid by taxpayers. The opportunity cost of government projects can thus be argued to be equal to the interest paid on long term debt, which taxpayers would otherwise not have to pay. For example, the long-term average rate of return on long-term bonds issued by the United Kingdom is approximately 3% in real terms i.e. net of inflation. However, government organisations tend to set higher discount rates than this.

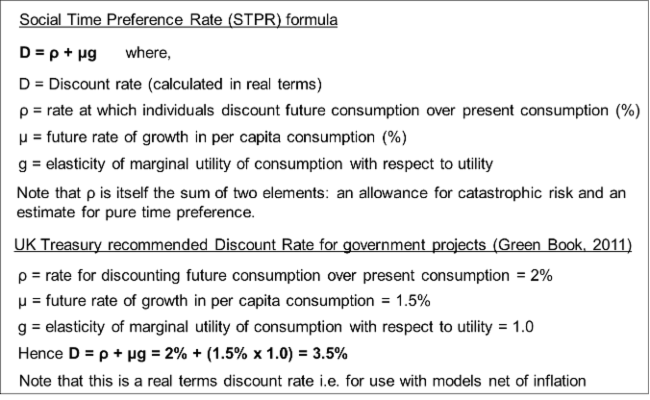

In the UK, the Treasury's rationale for its recommended standard discount rate is set out in the Green Book. The current discount rate is 3.5% in real terms, calculated using the Social Time Preference Rate (STPR) approach as summarised in the box below.

Many governments use the Social Opportunity Cost (SOC) as an alternative to STPR. SOC discount rates tend to reflect the cost in financial market terms.